Budget may offer financial support, credit to exporters, small businesses

NEW DELHI: To address a long-standing problem, the government may announce measures to boost financial support, including credit, for exporters and small businesses in the budget. The commerce department has already held discussions with the finance ministry on ensuring adequate credit flow and the availability of other instruments, such as factoring and credit guarantees, for exporters, who have been complaining that these are a significant drag on their competitiveness.

The department hired a consulting firm to examine the issues in detail. Based on the recommendations, North Block asked it to reassess some of them.

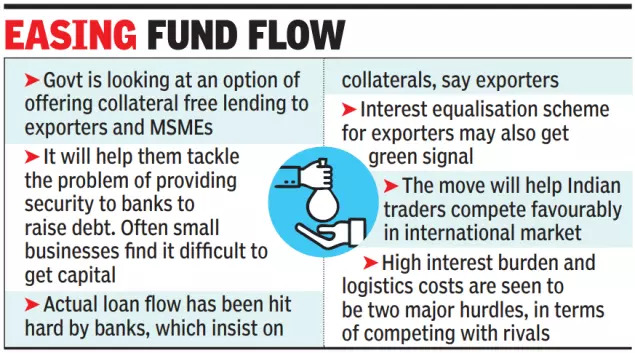

One option for exporters and MSMEs (micro, small, and medium enterprises) alike is collateral-free lending, which can help them tackle the problem of providing security to banks to raise debt. Small businesses, many family-owned enterprises with little distinction between personal and business assets, often find it difficult to get capital. Exporters have complained that the actual loan flow has been hit hard by banks, which insist on collateral.

After COVID-19, bank guarantee-based loans were seen as a huge help for businesses to access capital at reasonable rates. Banks lent freely without fear of sizeable bad debt.

For exporters, the interest equalisation scheme, pending with the finance ministry for months, may also get the green light. This would help Indian traders compete favourably in the international market, as the high interest burden and logistics costs are seen as two significant handicaps when competing with rivals from the region.

They believe small businesses and exporters, particularly those related to manufacturing, can generate large employment and overall economic activity. The idea is to help them overcome their challenges, and finance is a key one.

According to the latest RBI data, loans to micro and small enterprises have grown by 4.3% in the current financial year, while those to medium-sized businesses were up by 12%. Overall credit growth is 6.6%.