Bitcoin Price Nears $90,000 Amid Pro-Crypto Momentum, Analysts Target Six Figures by Year-End

Bitcoin price news is again in the headlines as the cryptocurrency surges to a near all-time high of $90,000. Immediately after Donald Trump’s win in the U.S. election, fueled by optimism over a pro-crypto administration, Bitcoin surged around 32%. With its price now hitting new highs, analysts believe Bitcoin is moving toward the six-figure mark, wherein the possible targets range from $100,000 to $200,000 by year-end.

Bitcoin Price Today: New Heights

At $89,599 today, Bitcoin entered a mode that experts called “price discovery.” According to H.C. Wainwright analyst Mike Colonnese: “Bitcoin is now in price discovery mode, reflective of a strong investor sentiment likely to be sustained throughout the year.” During this current rally, investors were hopeful for future earnings. This was mainly due to the president-elect, Donald Trump, promising them a regulatory environment that would not be hostile to cryptocurrencies.

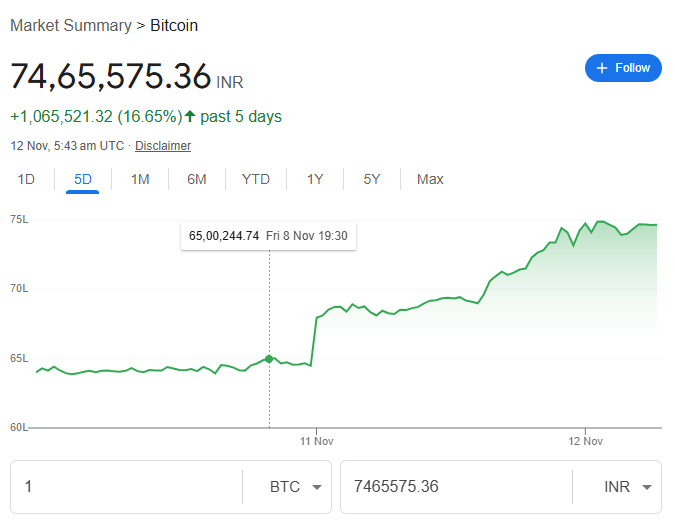

Bitcoin Price USD and INR: Global Ripple Effect

As Bitcoin’s recent rally has made headline news globally, investors worldwide cannot help but take a keen interest in tracking the cryptocurrency, be it in Bitcoin price USD or Bitcoin price INR terms. And considering the amplification of its value, Bitcoin has emerged as a global asset. The positive momentum for increased trading activities in international markets and the rising demand for cryptocurrency have also added to its bullish push.

Institutional Buying and Market Sentiment

Another unprecedented development within the cryptocurrency market is unprecedented participation by institutions, which enhances the uptrend for Bitcoin. Last week, MicroStrategy purchased 27,200 Bitcoins at about $2 billion to confirm that a demand still exists for the asset, pushing Bitcoin’s share price up to new highs. Also, as market data from Deribit Exchange show, institutional investors are positioning for Bitcoin to break the 100,000 threshold by the end of the year, reinforcing solid optimism in the market.

Bitcoin Price History

This demonstrates how the price history of Bitcoin has been extreme in terms of its extremes, from being modest to not even worth something in 2009 up to the near-$90,000 levels seen in today’s figures. It, in fact, experienced one of its first major price moves in October 2010 when it took off past $0.10, continuously rising past $1 and hitting multi-year highs over the next several years. While its volatility has attracted traders seeking short-term gains, it has attracted a second wave of people seeking the potential for a hedge against inflation and economic instability.

Policies Pro-Crypto and Bitcoin Mining Future

One of the most important cornerstones supporting the cryptocurrency network is Bitcoin mining- the operation of developing new Bitcoins and validating transactions. A combination of mining, on the one hand, and capped supply at 21 million Bitcoin, on the other hand, presents one of the major scarcity forces driving its value. Growing domestic Bitcoin mining under Trump’s pro-crypto agenda could positively support local industry and potentially enhance Bitcoin as a secure digital asset.

This includes establishing a “Strategic Bitcoin Reserve,” local Bitcoin incentives and mining, and crypto-friendly regulation. The existing administration has handled this cautiously, which might present a positive impetus for Bitcoin’s future valuation.

Analyst Projections on Bitcoin Share Price and Market

At Bitcoin’s price in USD nearing $90,000, investors can’t help but be optimistic, saying it’ll hit six figures by the end of the year. Analysts warn of caution, though, pointing out that there’s a good chance for a brief period of consolidation, but the sentiment is pretty bullish overall. Chris Weston, head of research at Pepperstone Group, noted, “It’s a matter of whether investors want to chase this trend now or wait for a pullback.”.

Bernstein analysts are very bullish and have a long-term price target of $200,000 in 2025. According to Gautam Chhugani, lead analyst at Bernstein, “A Trump administration could mean a crypto-friendly SEC and a favourable regulatory environment, making the U.S. a global crypto leader.”

Bitcoin price continues to rise, and keen analysts watch the goings-on worldwide. Significant pro-Bitcoin policies have created optimism among analysts that Bitcoin will be tested at new levels to reach a six-figure price level, thereby redistributing the cryptocurrency markets’ future landscape. Whether it’s an institutional investment or a strategic shift in US policy, the Bitcoin bull run will run deep into 2024.

FAQ:

Can I buy Bitcoin for 1000 rupees?

You can only buy a fraction of Bitcoin for 1000 rupees which also depends on the market rate of Bitcoin that time.

When was Bitcoin last $1?

From February to April 2011, Bitcoin lasted $1.

How much will 1 Bitcoin be worth in 2030?

According to Bitcoin Price Prediction in 2030, 1 Bitcoin will be $ 117,825.80.

How much is 1 Bitcoin to buy?

1 Bitcoin is 6,725,777.67 INR to buy.

How long will it take to mine 1 Bitcoin?

It takes roughly an average of 10 minutes to mine not just 1 but 3 Bitcoins, and that rate fluctuates over time.