Wipro’s 50% Share Price Drop Explained: Bonus Issue Sparks Investor Queries

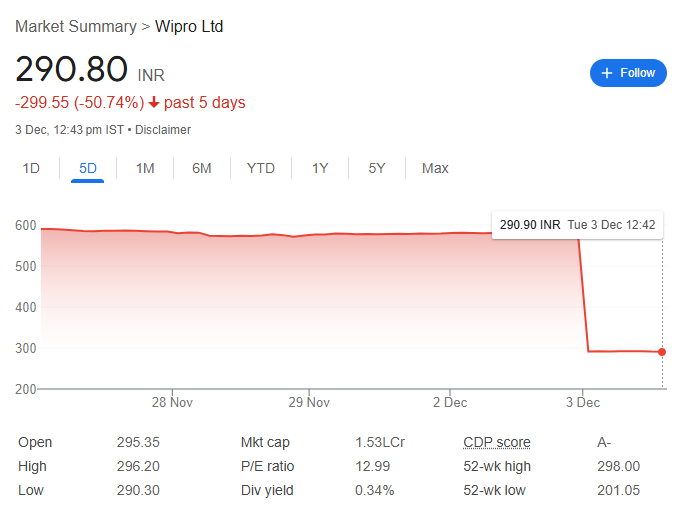

Wipro Ltd. has been the talk of town on December 3, 2024, after its share price has crashed by 50% on some mobile trading platforms, but this alarming crash has nothing to do with the market performance and everything to do with a technical adjustment in the wake of its 1:1 bonus share issue.

What Caused the Apparent 50% Fall?

The problem was Wipro’s former bonus price adjustment. In a 1:1 bonus share issue, the shareholder gets one more share for every share held. To adjust for this, the stock price is halved to reflect the higher number of shares without changing the company’s total market capitalization. The adjusted price created a seeming 50% drop in Wipro shares price on some platforms, creating a temporary scare among lesser-informed investors.

Bonus Shares Objective

Bonus shares are corporate action to incentivize shareholders and make stocks more liquid. With the per-share price diluted, the investor‘s holdings in total value do not change. Such measures help make stocks accessible to more retail investors and thus improve trading volumes and the base of shareholders

Wipro’s Recent Financial Actions

This bonus issue aligned with the strong Q2 FY25 performance of the company. Wipro said that it reported a 21% increase in net profit at ₹3,209 crore while beating market expectations on consolidated revenue that dipped by 1% to ₹22,302 crore. It also booked large deal bookings worth $1.5 billion, which reflects its resilience and robust future pipeline.

Investor Takeway

The incident underlines the need to understand corporate actions like bonus issues and stock splits. While these adjustments may temporarily confuse investors, they do not reflect financial losses or gains. Experienced investors knew what the ex-bonus adjustment was, but the event underlined the need for greater awareness in the trading community.

Market Implications and Future

Wipro’s bonus share issuance and robust quarterly results demonstrate its strong commitment to long-term value creation. Despite the short-lived confusion, the company still remains better positioned to continue its growth momentum given its strong pipeline of deals and continued innovation across areas like AI.