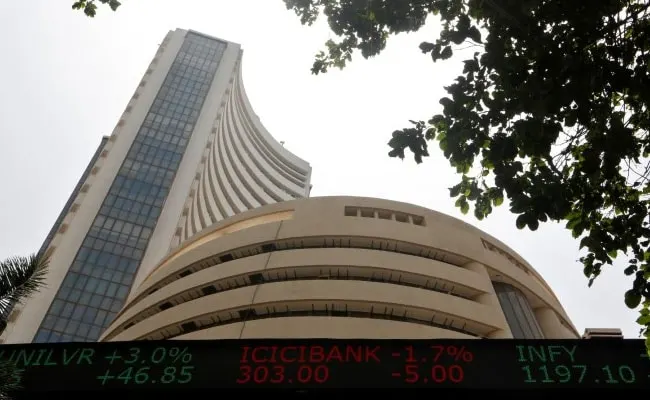

Financial backers’ Abundance Rises ₹ 2.4 Lakh Crore Toward the beginning of today As Business sectors Scale New Pinnacles

New Delhi: Value financial backers became more extravagant by ₹ 2.4 lakh crore as key benchmark records Sensex and Clever scaled new tops in morning exchange today, in the midst of persevering unfamiliar asset inflows.

Investigators said unfamiliar institutional financial backers have switched their selling system and have been reliable purchasers during the most recent seven days. This force is an impression of institutional trust in the Indian market, they said.

The 30-share BSE Sensex hopped 169.94 focuses, or 0.25 percent, to another pinnacle of 69,035.06 in early exchange. The more extensive record Clever additionally climbed 52.60 focuses, or 0.25 percent, to hit its unsurpassed high of 20,739.40.

Following the assembly, the market capitalisation of BSE-recorded firms hopped by ₹ 2.4 lakh crore to ₹ 345.88 lakh crore in morning bargains on Tuesday, from ₹ 343.48 lakh crore on Monday.

Among the Sensex firms, Adani Ventures and Adani Ports supported their picking up speed and exchanged higher by 4.40 percent and 4.37 percent, individually. BPCL, Pivot Bank, Mahindra and Mahindra and SBI were the other significant gainers.

Upwards of 20 supplies of the 30-share benchmark were exchanging the positive domain. Among Clever stocks, 29 offers enlisted gains.

In six exchanging meetings, financial backers’ abundance has gone up by ₹ 17.16 lakh crore.

In the more extensive market, the BSE midcap check bounced 0.54 percent and smallcap file climbed 0.50 percent.

The joined market valuation of all recorded organizations on the BSE arrived at the USD 4 trillion-achievement out of the blue on November 29.

The market capitalisation of recorded organizations on the NSE has outperformed the USD 4 trillion (Rs 334.72 trillion) mark unexpectedly on Friday.

As per Siddhartha Khemka, Head – Retail Exploration, Motilal Oswal Monetary Administrations Ltd, Indian values observed BJP’s broad triumph in the three states by energizing in excess of 400 focuses to hit new highs.

“The result predominantly for the occupant BJP, solid macroeconomic information and facilitating worldwide loan fee assumptions helped the market energy. Clever has energized by 1,865 or 10 percent from its low of 18,837 made on October 23.

“We anticipate that market feeling should reinforce further as the continuous pre-political decision rally is serious areas of strength for very. Given the public authority’s center methodology towards long haul capex across key regions, we expect BFSI, Industrials, Land, Auto and Purchaser Optional to do well proceeding,” Khemka added.