Hyundai Share Price India: IPO Listing and Market Updates

Hyundai Shares Price India finally hit the Indian stock exchanges on October 22, 2024. Even as the company went gung-ho over its Initial Public Offering, the share in the street opened at Rs 1,934, down 1.32% from its issue price of Rs 1,960. The opening here seems to echo the lukewarm reaction seen in retail and non-institutional investors.

Hyundai IPO Name and Offering Details

Hyundai’s IPO, officially named “Hyundai Motor India Ltd,” is the largest floated company in history, and it has raised Rs 27,870.16 crores. It opened for subscription between October 15 and October 17. The price band is set at Rs 1,865 to Rs 1,960 per share, and the final allotments were confirmed on 18th October with the listing today. This is an entirely OFS with no fresh issue of shares, which might have impacted demand from retail investors.

Hyundai Share Price India Listing Date

Hyundai shares were officially listed at the NSE and the BSE on October 22. The Hyundai share price in India was opened below the issue price despite the solid interest displayed by qualified institutional buyers or QIBs. They oversubscribed their portion by nearly 700%. The retail and non-institutional investors, or NIIs, did not show the same enthusiasm as QIBs since the retail portion was subscribed to by just around 50%.

Hyundai Share Price India GMP and Investor Sentiment

At the outset, Hyundai’s grey market premium, which had been very volatile in the run-up to the listing, touched Rs 570 at the end of September. However, at one point last week, it turned negative before stabilizing at Rs 45-50 ahead of listing. This puts the GMP at 2% above the issue price or below the previous 3-5% estimate. The very volatile GMP indicated shifting investor sentiment ahead of the listing.

Analysts sounded cautious as they put down Hyundai’s share price in India, as most of them were expecting the stock to list flat to moderately, with GMP trends and the overall market scenario remaining dull.

However, despite the lacklustre debut, some analysts say that the company’s long-term trajectory remains intact.

Hyundai Share Price India Moneycontrol Analysis

According to Moneycontrol experts, the issue of high valuations compared with industrial peers has compounded the Hyundai IPO. Moreover, slowing demand in the automobile sector over the last few months and an oversupply scenario have pressed down investor sentiment. An OFS structure that facilitates 100 per cent and has no fresh capital injection for the company has not generally left much reason for new investors.

Hyundai has seen its IPO fully subscribed at 2.37 times, while the significant bulk has been coming from QIBs, whereas retail and NII segments’ demand seems relatively weaker. This gap between the two seems to have affected the stock’s underperformance on its listing day.

Hyundai Share Price Target NSE

As the trading on the NSE continues, short-term investors have to be very careful. The target price for Hyundai NSE has not yet been determined since analysts say investors should wait for the stock to stabilize. For non-allotters, waiting for a better entry point is advisable, as market volatility is expected to continue in the coming days.

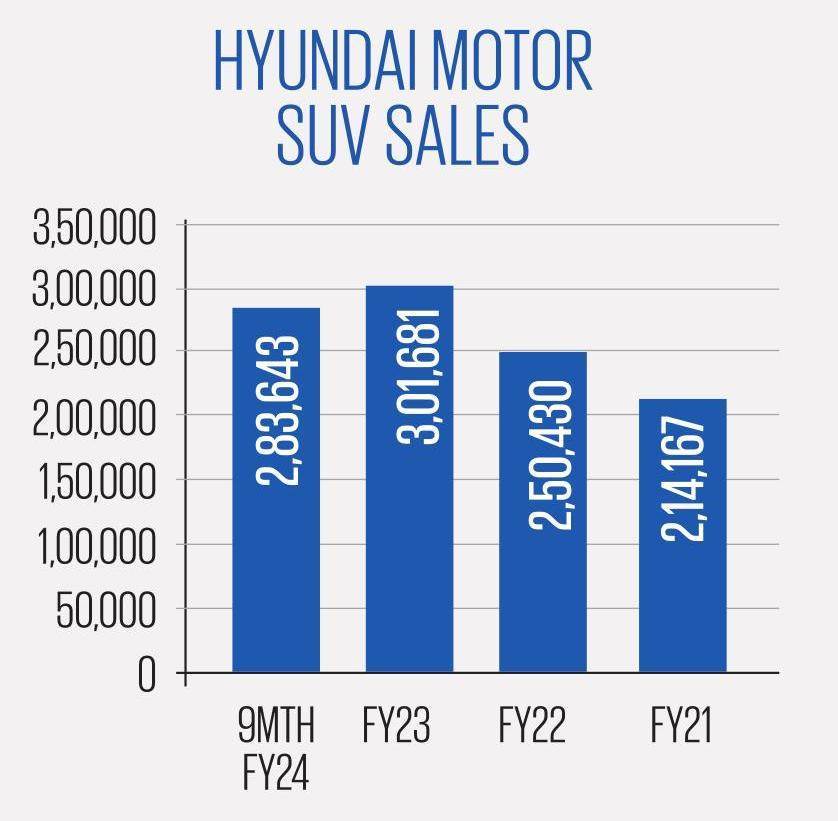

Indeed, for long-term investors, Hyundai can be attractive, with a strong market position in India and an SUV manufacturing focus. The analysts reckon that they are holding the stock for future growth, considering that Hyundai remains the second-largest player in the Indian passenger vehicle market, even though the listing has softened.

Hyundai’s stock might face challenges in the short term; however, taking all points with the company’s fundamentals, there are great promises for patient investors about the long-term scenario of the company in the Indian automotive market.

FAQ:

Is Hyundai listed in the Indian stock market?

Yes, Hyundai is listed in the Indian stock market.

What is the price of Hyundai shares in India IPO?

The price of Hyundai’s shares in India IPO is ₹1,934.

Is Hyundai an excellent stock to buy?

For allotted investors, it wouldn’t earn them quick bucks on listing day.

How to get a Hyundai IPO?

Through a Zerodha account, one can buy Hyundai shares.

How to buy Hyundai stock in India?

Through a Zerodha account, you can buy Hyundai stock in India.