Raymond Share Drops 66% After Realty Split: New Start Ahead

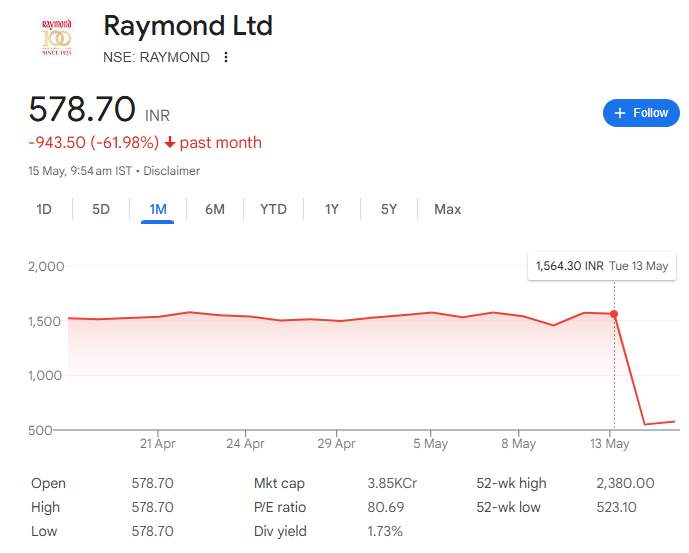

On May 14, 2025, Raymond Ltd.’s stock took a wild ride, plummeting 66% from ₹1,561.30 to ₹523.10 on the NSE. If you’re an investor, that kind of drop might make your heart skip a beat! But hold on—this isn’t a disaster. It’s a technical adjustment after Raymond spun off its real estate arm, Raymond Realty, into a separate company on May 1, 2025. The goal? To unlock value for shareholders and let both businesses shine on their own. Let’s break it down in simple terms, with a mix of straight talk, key points, and a handy table to make sense of it all.

Raymond Share News

The demerger of Raymond Realty has dominated headlines, with the stock hitting a 52-week low on the ex-date, May 14, 2025. This follows the company’s broader restructuring strategy, which included spinning off its lifestyle business, Raymond Lifestyle, in September 2024. The market’s reaction, though sharp, is a recalibration as Raymond Ltd. now trades without the real estate segment’s value. Investors are optimistic about the long-term potential of both entities.

- Record Date Impact: May 14 was set as the record date to determine shareholders eligible for Raymond Realty shares.

- Shareholder Benefit: For every Raymond Ltd. share held, investors receive one Raymond Realty share, ensuring no loss in overall value.

- Market Sentiment: Posts on X reflect mixed reactions, with some celebrating the strategic split and others wary of the immediate price drop.

Raymond Share Split

No share split has been announced recently for Raymond Ltd. The focus remains on the demerger, which has effectively split the company’s operations into distinct entities. This restructuring is designed to enhance operational efficiency and attract specialised investors to each vertical.

Raymond Share Demerger

The demerger, finalised on May 1, 2025, separates Raymond Realty as an independent entity. Raymond Ltd. shareholders will hold equity in both companies, with Raymond Realty expected to list on the NSE and BSE by September 2025 (Q2 FY26). The move aligns with Raymond’s goal to streamline operations and capitalize on India’s booming real estate market.

| Aspect | Details |

| Demerger Effective Date | May 1, 2025 |

| Share Allotment Ratio | 1:1 (One Raymond Realty share per Raymond Ltd. share) |

| Listing Timeline | Expected by September 2025 (Q2 FY26) |

| Strategic Goal | Unlock shareholder value and focus on core competencies |

Raymond Stock Demerger

The stock demerger has led to a technical price adjustment, not a sell-off. Raymond Realty’s robust performance, with ₹766 crores in revenue (up 13% YoY) and a ₹399 crore cash surplus, underscores its potential as a standalone entity. Meanwhile, Raymond Ltd. continues to strengthen its textiles and apparel segments.

Raymond Stocks

Raymond Ltd.’s stock has faced volatility, with a 67.22% decline over the past 12 months. However, the demerger is seen as a catalyst for future growth, with analysts eyeing recovery as both companies establish their market positions.

Raymond Share Price Target 2025

Analysts remain cautious but optimistic:

- Short-Term: Targets range from ₹600–₹800, factoring in post-demerger stabilisation.

- Long-Term: Potential to reach ₹1,200 by late 2025, driven by textiles recovery and Raymond Realty’s listing.

- Key Driver: Raymond Realty’s ₹5,000 crore Mumbai project could boost investor confidence.

Why Raymond’s Share Price is Falling

The 66% drop is a technical adjustment from the real estate business spin-off. The stock no longer reflects Raymond Realty’s value, causing the sharp decline. However, investor holdings remain intact, with added exposure to a promising real estate venture.

Raymond Share Dividend

Raymond has a history of consistent dividends, with a yield of 0.64% as of May 14, 2025. The latest dividend of ₹10 per share was announced on May 3, 2024. Post-demerger, dividend policies for both entities will be closely watched.

In conclusion, Raymond’s demerger marks a bold step toward value creation. While the immediate price drop may unsettle investors, the strategic split positions Raymond Ltd. and Raymond Realty for sustainable growth, making it a story of transformation rather than loss.

FAQs

Is Raymond a good stock to buy?

Raymond has shown a profit growth of 57.07 per cent in the last 3 years.

Why is Raymond’s share falling?

The Raymond share is falling because of its transfer to the newly created entity, Raymond Realty.

Is Raymond undervalued or overvalued?

According to some analysts, Raymond is considered overvalued.

Is Raymond in the loss or profit?

Over the past 5 years, Raymond has shown a significant increase in profit.

Is Raymond debt-free?

Yes, Raymond is debt-free.