New Year cheer for PF subscribers! Faster automatic EPFO claim settlement process in works

New Year’s cheer for Provident Fund subscribers! The Labour and Employment Ministry has established a five-person committee to develop a strategy for expediting EPFO auto-claim settlements while eliminating manual processing requirements. This initiative will affect more than 75 million EPFO members.

EPFO currently permits automatic settlement of partial withdrawals up to Rs 1 lakh for housing, education, and marriage purposes, compared to the previous Rs 50,000 limit for medical expenses.

Additionally, EPFO offers automatic settlement for all pension claims under the Employees’ Pension Scheme (EPF) or provident fund, subject to application validation.

“The idea is to make the automatic claim settlement process more technically savvy and seamless while substantially reducing rejections,” a senior government official told ET. According to the official, the committee, led by G Madhumita Das, the ministry’s financial advisor, is scheduled to present its findings by mid-next month.

Internal evaluations indicate that only 40% of claims achieve automatic settlement, and over 60% are rejected due to validation issues.

Consequently, these rejected applications require manual processing, significantly extending the settlement timeline.

“The plan is to simultaneously do away with unnecessary validations to bring down the rejection rate,” the official said.

As noted by the source, applications must pass through 27 back-end validation checks before settlement processing begins.

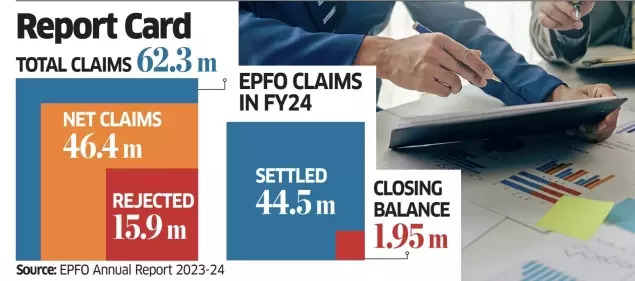

In 2023-24, EPFO processed 44.5 million claims. The settlement timeline showed that 13.9 million claims were completed within three days, 14.3 million within 10 days, 14.5 million within 20 days, and 1.8 million required more than 20 days.

The settled claims comprised 40.9 million provident fund (PF) claims, including final settlements, advances, and partial withdrawals; 3.45 million pension-related claims and benefits; and 75,000 insurance claims under the Employees’ Deposit Linked Insurance Scheme (EDLI).