Alphabet’s Q1 Soars: AI-Powered Profits Crush Expectations!

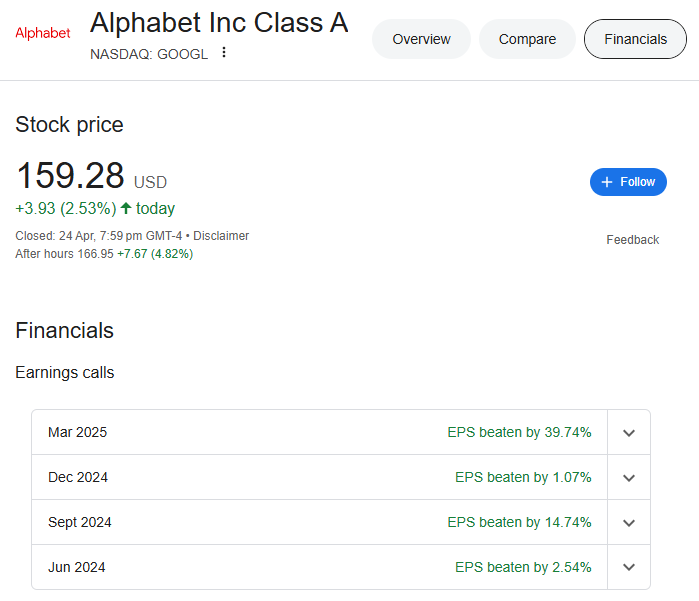

The latest earnings report from Alphabet has been getting the market talk. The report was released after the market closed on April 24, 2025; the Alphabet Earnings Report news describes a marvellous performance in Q1. The company stock jumped 4.6% in after-hours trading. There is much excitement among investors, and rightly so. The focus on AI and cloud computing has paid off for Alphabet. Now let’s get into the details of this blockbuster report.

Alphabet Earnings Report 2025: Key Highlights

Strong Growth Marks Alphabet Earnings Report 2025: Alphabet realised revenue growth of 12% for the year, reaching $90.23 billion, versus some earnings of $80.54 billion in the first quarter of 2024. The net gain jumped 46% to $34.54 billion, whereas diluted earnings per share (EPS) rose by 49% to $2.81, above the analysts’ projected $2.01. This performance shows that Alphabet can capitalise on emerging trends in already high-demand sectors like AI and cloud computing.

Here’s a quick snapshot:

- Total Revenue: $90.23 billion (+12% YoY)

- Net Income: $34.54 billion (+46% YoY)

- EPS: $2.81 (+49% YoY)

- Operating Income: $30.61 billion (+20% YoY)

- Operating Margin: 34%

Google Q1 Earnings 2025: Segment Breakdown

The Google Q1 Earnings 2025 report showcases strength across multiple segments, including YouTube and Google. Google Ads remained a cash cow, generating $66.89 billion. Google Cloud was the star, with a 28% revenue increase to $12.26 billion. Subscriptions and other services also contributed to the growth. Alphabet’s diversified portfolio is firing on all cylinders.

| Segment | Q1 2025 Revenue | YoY Growth |

| Google Ads | $66.89 billion | Stable |

| Google Cloud | $12.26 billion | +28% |

| Subscriptions/Other | Not disclosed | Positive |

Alphabet Earnings Report Analysis: What Drove the Success?

The Alphabet Earnings Report analysis reveals AI as the secret sauce. Alphabet’s heavy investments in AI are boosting cloud and ad performance. Google Cloud’s profitability expanded significantly, driven by AI-related demand. The search business also thrived, fueled by more intelligent algorithms. Alphabet’s ability to integrate AI across its ecosystem is paying dividends. However, not everything was perfect. Cloud revenue slightly missed some aggressive estimates, raising minor concerns.

Key drivers of success:

- AI Innovation: Enhanced cloud and search capabilities.

- Cloud Growth: 28% revenue surge, with improved margins.

- Ad Resilience: Steady performance despite market volatility.

- Dividend Hike: A 5% increase signals confidence.

- Buyback Program: $70 billion authorised for share repurchases.

Alphabet Earnings Report Time and Presentation

The Alphabet Earnings Report time was strategically set post-market on April 24, 2025. This allowed investors to digest the numbers overnight. The Alphabet Earnings Presentation was a polished affair. CEO Sundar Pichai emphasized AI’s transformative impact. CFO Ruth Porat highlighted margin growth and capital allocation. The presentation, available on Alphabet’s investor website, is worth a watch for deeper insights.

Alphabet Earnings Headwinds: Challenges to Watch

Despite the stellar results, Alphabet Earnings headwinds exist. Regulatory scrutiny remains a concern. Antitrust cases could disrupt operations. Cloud competition is heating up, with AWS and Azure closing the gap. Macroeconomic factors, like potential U.S. tariffs, could also weigh on growth.

Potential risks:

- Regulatory Pressure: Ongoing antitrust investigations.

- Competition: Fierce rivalry in cloud and AI.

- Economic Uncertainty: Tariffs and global volatility.

Final Thoughts

Alphabet’s first-quarter performance of 2025 proves its resilience and innovation. While investors remain optimistic, challenges are ahead. The prime challenge will be for Alphabet to stay ahead in AI and cloud. As for now, the market is basking in the glory of a quarter that proved to be an upside surprise. Stay tuned for more updates about Alphabet’s continued role in shaping the future of technology.

FAQs

What is the earnings prediction for Alphabet?

Alphabet, the parent company of Google and YouTube, reported revenue of more than 5% in the first quarter of 2025.

How is the Alphabet doing financially?

Alphabet is showing good revenue at the start of 2025.

Is Alphabet a buy holds or sell?

Currently, Alphabet, Inc. has been Zacks Rank 3 and with this information, deciding to wait a little longer for better entry price might be a good idea.

What is the earnings growth of Alphabet?

The growth in the first quarter is reported between 12% and 14%.

Is it good to invest in Alphabet?

Yes, it is an excellent investment to generate huge revenue in the long run.

Is Alphabet a profitable company?

Yes, Alphabet is a profitable company. Net income for the first quarter was $34.54 billion, up from $23.66 billion a year earlier.