Bajaj Finance Share Dips 5% Post Q1; Profit Up, NPA Concerns Rise

Bajaj Finance Share Price: India’s top non-banking financial company (NBFC), Bajaj Finance, has been in the news with its current performance and corporate activity. The firm had a great Q1 FY26, but its shares took a 5% hit because of fear about increasing non-performing assets (NPAs) in the MSME book. For all that, strong profit growth and strategic activities such as stock splits and bonus issues have investors betting high on its future.

Bajaj Finance Share News: A Mixed Bag of Growth and Challenges

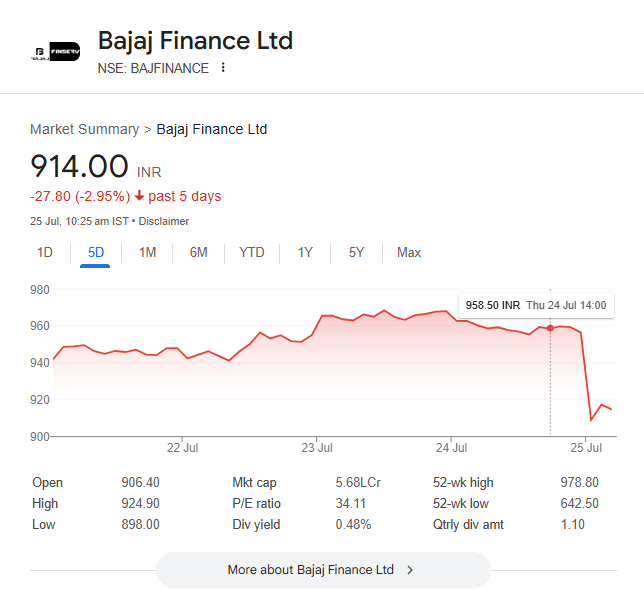

Bajaj Finance Ltd. saw its 10% increase in profit to ₹4,765 crore in Q1 FY26, led by robust loan disbursements and a 21% growth in net interest income. The assets under management (AUM) of the company jumped 26% to ₹4.41 lakh crore, showing high credit demand. Nonetheless, shares declined 5.29% to ₹908.25 on July 25, 2025, after the MSME segment reported higher stress, which reflected concerns over asset quality. Adding to the investors’ worry was the exit of Managing Director AnupSaha, though the hiring of Rajeev Jain as Vice Chairman and MD indicates a smooth succession.

Bajaj Finance Share Price Target: Analysts Remain Bullish

The recent fall notwithstanding, analysts are optimistic about Bajaj Finance’s long-term prospects:

- Jefferies: Has a “Buy” call with a target of ₹1,044, seeing 20% CAGR in profits for FY25–28 and a 19% return on equity in FY26.

- Axis Securities: Bullish with a target of ₹10,500, attributing good fundamentals.

- UBS: Recalls its “Sell” call with a lower target of ₹750, highlighting MSME stress and invariable credit cost guidance of 1.85–1.95% for FY26.

Bajaj Finance Share Price Target 2025: A Promising Outlook

For 2025, the growth path for Bajaj Finance is robust, backed by its diversified loan book and digitalisation efforts. The company is targeting a 25–27% AUM expansion and 23–24% bottom-line expansion in FY26. Analysts’ consensus 12-month target price stands at ₹935.95, implying a marginal overcurrent level of ₹924.65, driven by its increasing customer base of more than 100 million.

Bajaj Finance Share Split: Enhancing Accessibility

On 29 April 2025, Bajaj Finance declared a 1:2 stock split, where one ₹2 face value share was replaced with two ₹1 shares. Executed by 27 June 2025, the step was taken to improve liquidity and bring in retail investors. The split, implemented from 16 June 2025, reduced the stock price from more than ₹9,000 to approximately ₹938.50, making the share more accessible.

Bajaj Finance Share Bonus: Rewarding Shareholders

With the split, Bajaj Finance announced a 4:1 bonus issue, issuing four bonus shares against every share. This augmented shareholders’ holding substantially, for instance, 100 shares turned into 1,000 post-split and bonus. The record date was June 16, 2025, without changing the fundamentals of the company.

Bajaj Finance Share Price History: A Multibagger Journey

Bajaj Finance has been a brilliant performer:

- 2025 YTD: UP 38%, outperforming the BSE Sensex’s 5% rise.

- One-Year Gain: 27%, with a 52-week high of ₹9,785.9 and a low of ₹6,376.6.

- Five-Year Return: An impressive 279%, solidifying its multibagger credentials.

Bajaj Finance Share’s Bonus History: Regular Rewards

The firm has a tradition of rewarding investors. Its last 4:1 bonus in 2025 was its first since 2016, when it issued a 1:5 split. Apart from this, a ₹56 dividend (₹44 final + ₹12 special) has been declared for FY25, with the payment due in May and July of 2025.

Bajaj Finance Share Price NSE: Current Snapshot

As of July 25, 2025, Bajaj Finance is listed at ₹908.25 on the NSE, with a market capitalisation of ₹56,441.26 crore. Despite short-term fluctuations, its solid fundamentals and well-timed corporate actions make it the best bet for long-term investors.

Bajaj Finance continues to walk that tightrope between growth and challenges, making it a stock to track in 2025.

FAQs

Is Bajaj Finance a good stock to buy now?

Buying Bajaj Finance stock depends on the individual investment and risk tolerance; thus, it depends on whether it is a good stock to buy or not.

What is the price target of Bajaj Finance?

The price target of Bajaj Finance falls within the range of 9,500 INR to 10,500 INR.

What is the future of Bajaj Finance?

Bajaj Finance is expected to maintain its strong growth trajectory, driven by its expanding digital ecosystem, diversified loan portfolio, and focus on customer acquisition and asset quality.

Will Bajaj Finance share split?

Yes, Bajaj Finance will undergo a share split.

Is Bajaj Finance giving bonus shares?

Yes, Bajaj Finance has given a bonus share issue. Specifically, they approved a 4:1 bonus issue, meaning shareholders received four additional shares for every one share they held.