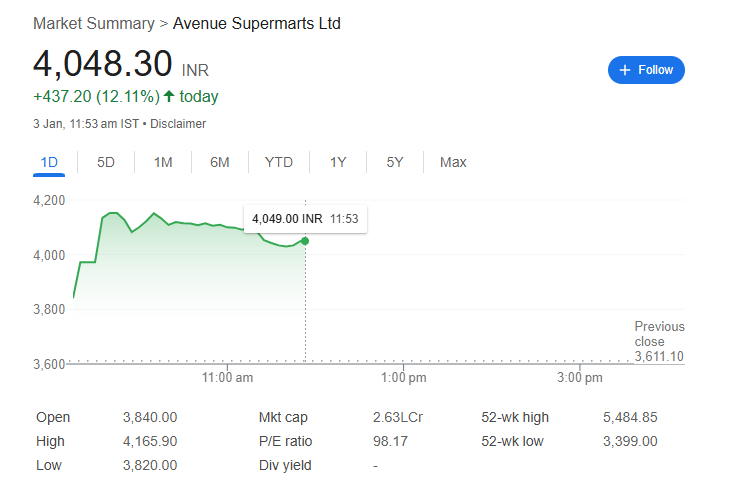

DMart Share Price Jumps 15% Following Q3 Business Update

DMart Share Price: The Avenue Supermart stock, the parent organization of the DMart supermarket chain, increased 15% to ₹4,152.75 on the NSE on January 3, 2025. The solid addition came following the hopeful business update by the organization for the December 2024 quarter, or Q3 FY25, which detailed significant income development and extension of its stores.

DMart’s solid financial position and strategic store opening are all set to continue to keep the company in leadership in the retail sector. Investors and analysts keep betting their optimism for the prospects in 2025 and beyond.

DMart Share Price News

DMart reported standalone revenue from operations of ₹15,565.23 crore for Q3 FY25, up 17.49% year on year (YoY) contrasted and ₹11,304.58 crore in a similar period last year. The organization added 10 new stores in the December quarter, taking into consideration the 387 stores on December 31, 2024.

The Q2 FY25 results had previously established an uplifting tone, with a 5.78% ascent in consolidated net benefit to ₹659.44 crore and a revenue increment of 14.41% YoY.

DMart Share Price Today

On January 3, 2025, DMart’s shares touched ₹4,152.75 on the NSE as the market responded decidedly to the quarterly outcomes and revenue growth. Analysts view the stock as a key performer in the retail sector.

DMart Share Price Target 2025

Market analysts have projected a cost range of around ₹5,300 for DMart shares in 2025. This will rely upon the organization’s capacity to keep up with its development force. The development of its store organization and improvement in functional proficiency are probably going to assume a critical part in accomplishing these objectives.

DMart Share Price History

DMart’s share cost has grown surprisingly since its Initial public offering in 2017, reflecting financial backer trust in its plan of action and consistent performance. The stock has turned into a favorite among long haul financial backers, with periodic peaks driven by strong quarterly results.

DMart Share Price BSE

Avenue Supermarts is also another retail stock that has seen a similar upward surge in its price on the Bombay Stock Exchange (BSE).

DMart Share Price Screener

Stock screeners have marked DMart as one of the strongest contenders for the retail segment. The stock constantly features in “buy” suggestions from analysts on account of its steady growth, smart cost control, and market leadership.

FAQs

What is the price target of DMart?

The price target of DMart shares for 2025 will be ₹5,300, provided it continues to gain revenue and expands its stores.

Has DMart declared dividends?

No, DMart has not declared dividends but reinvests its profits into expansion and operations.

What is the future of DMart stock?

It has continuously high revenue growth with efficient cost management and aggressive expansion plans that give positive views about its future.

Can I buy a DMart share?

Yes, shares can be bought from both NSE and BSE, but the stock valuation and the investor’s investment requirements must be judged.

Why is DMart not growing?

DMart is growing, but the rate appears relatively slower in certain urban markets where saturation may have happened. However, it focuses on increasing in Tier-2 and Tier-3 cities, which gives steady long-term growth.