Infosys Shares Price 1.9% on Buyback News, Market Optimism Grows

Infosys Share Price: In the ever-fluctuating sands of the stock market, few pieces of information weigh as heavily as a delicious share buyback. India’s IT behemoth Infosys made trading desks a little brighter on September 12, 2025, with news of its largest-ever buyback proposal, sending shares up by nearly 2% from the opening bell. As investors welcome this vote of confidence from the board of this firm, let’s see what this does to your portfolio, and why excitement is building about this tech behemoth’s future.

Unveiling the Latest Infosys Share Price News

Think of this: It’s a Friday morning, and the opening bell sounds with Infosys shares jumping over 2% in early trades. What’s driving it? A huge ₹18,000 crore buyback plan that screams “we believe in our value.” This isn’t just any buyback, Infosys’s biggest ever by the company, aimed at giving money back to shareholders and reducing the supply of shares. Analysts are calling it a masterstroke in the midst of economic jitters globally, reporting Infosys’s more-than-anticipated Q1 earnings win.

With digital transformation contracts pouring in waves from Fortune 500 customers, the news has revived faith in the sector’s resilience. But is the surge a flash in the pan or the start of a bull run? Discover as we dive into the ripples.

Fresh Scoop: Infosys Share Price Latest Update

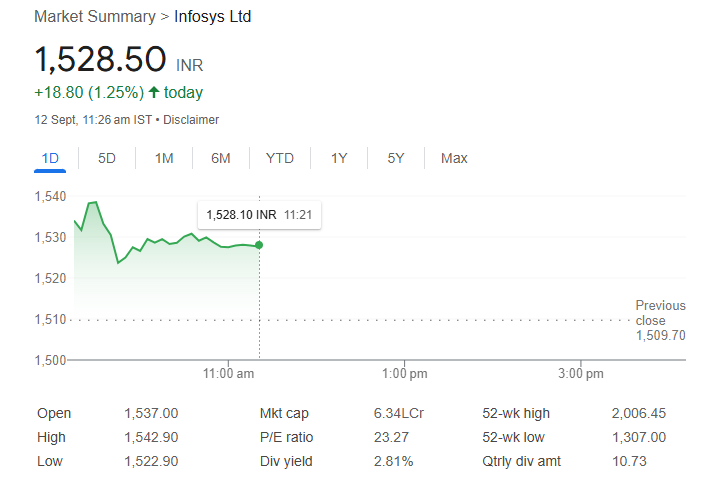

Flash-forward to September 12 today, and the update is in the runs. Shares began firm, hitting a day’s high of roughly ₹1,560 on the NSE from Thursday’s close of ₹1,532.65. The stock had gained 1.9% by mid-morning, a sign of general market euphoria. Volume accelerated to over 13 million shares, well above the norm, as retail and institutional investors poured in. Traders’ whispers pinpoint Infosys’s artificial intelligence-driven revenue streams, 15% year-on-year growth, and where the real sparkplug lies. But with American Speculations of a Fed interest rate cut rampant, will outside breezes dampen this spree? For now, all go signals, but smart investors are eyeing the upcoming buyback record date.

Focus on Infosys Share Price NS

On the National Stock Exchange, Infosys has been a consistent performer, but today’s activity stole the limelight. Current price at ₹1,552 at noon, up 1.3% from open, day’s high-low at ₹1,540-₹1,565. The NSE liquidity advantage makes it the choice for high-frequency trade, and this morning’s spike vindicates it. To compare with peers such as TCS, Infosys’s 52-week high of ₹2,006 seems achievable if buyback mania continues. What provides NSE an advantage here? Real-time depth shows buy orders accumulation, implying high interest. If you are a day trader, this is the optimum time; volatility is your friend.

BSE Buzz: Infosys Share Price BS

Shifting to the Bombay Stock Exchange, the mood is akin to that on NSE, with the addition of an institutional tilt. BSE quotes valued the stock at ₹1,550 at noon, mirroring the 1.9% surge, with similar volume increases. BSE has historically seen Infosys’ brilliance during buyback times, and even here, that’s no exception. The exchange depth reflects heavyweights like mutual funds layering up, banking on long-term IT recovery. With a P/E approaching 25, it’s undervalued compared with peers, an overseas value hunters’ bonanza.

Shooting for the Stars: Infosys Share Price Target

Analysts don’t mind showing their preference for the bulls. Broader objectives congregate around ₹1,700 at the end of the year, driven by premium pricing for the buyback and Q2 guidance. Brokers such as Motilal Oswal target ₹1,650 based on margin increases from cloud orders. Risks? Geopolitical tensions may shave that, but the consensus is optimistic, hold or buy on dips.

Long-Term Vision: Infosys Share Price Target 2030

Gazing ten years ahead, the crystal ball glows. Forecasts put Infosys at ₹1,925 in 2030, a 25% increase from current levels, on the back of AI and automation prowess. Other seers predict as much as ₹1,830 by 2029, on the back of a steady 12% CAGR of revenues. In a world that is thirsty for digital upgrades, Infosys’s stake in the ecosystem from Finacle to Infosys Living Labs makes it a blue-chip gem. Inflatable bubbles of technology and inflation aside, this might be your pension rocket.

Journey Through Time: Infosys Share Price History

Rewind to 1993, when Infosys listed at a humble ₹95 (split-adjusted). The Y2K boom catapulted it to ₹8,000 peaks in 2000, only for the dot-com bust to bite. Post-2008, it clawed back, hitting ₹2,000 in 2021 amid pandemic-fueled digitisation. From ₹1,307 lows in 2024 to today’s highs, the ride’s been volatile yet rewarding, delivering 15x returns over two decades. Lessons? Buybacks like this one have historically juiced 10-15% pops.

The Big Move: Infosys Share Price Buyback

At the heart of the rally: That ₹18,000 crore elephant in the room. Infosys is to purchase 10 crore shares at ₹1,800, a 19% premium, under a tender offer, lowering equity by 3%. Board approval on September 11, with EGM looming. This is not a cash splash; this is a shareholder hug, yielding a 3-4% EPS boost. Earlier buybacks in 2017 and 2021 provided 20%+ returns; history rhymes.

And as the dust settles, Infosys embodies tech’s eternal allure. Buyback blues turning greens, positivity isn’t rising, it’s charging. If you’re in for the short dash or a marathon, this chapter is a page-turner.

FAQs

What is the Infosys target price in 2025?

The Infosys target price is Rs 1,660 in 2025.

Suppose I had invested 10000 in Infosys in 1993?

An investment of ₹10,000 in Infosys’s IPO of 1993 would have become more than ₹15 crore today, but this amount is calculated differently based on the precise date of valuation and with or without including subsequent bonus shares and stock splits.

Is Infosys a good buy long-term?

Infosys seems to be a good long-term investment option, as analysts at companies such as Choice Broking and Jefferies have a positive view owing to the rising demand for AI as well as cost-saving measures.

Will Infosys give a bonus in 2025?

No, Infosys did not declare bonus shares in 2025; however, they declared a final dividend of ₹22 per equity share for the year ending March 31, 2025, with an ex-date of May 30, 2025, and a record date on the same date.

What is the 10-year return of Infosys?

The 10-year return on Infosys depends on the source. Whether dividends and other elements are included, the average has been about 10% to 14% each year (or 100-140% cumulative), with some sources reporting a considerably higher cumulative return of about 180% including dividends.

How much to invest to earn 5 crore in 10 years?

To build ₹5 crore in 10 years with monthly SIP investments at a rate of return of 12% per annum, you must invest about ₹28.5 lakh every year (or ₹2.37 lakh every month).

H2betapp is another solid mobile option. I like the interface and the variety of available choices. Perfect for gaming on the move! h2betapp

GG777a is legit! I’ve cashed out a couple of times with no issues. That’s a win in my book! Go get yours: gg777a

So, I was checkin’ out 16betbr1 the other day, and it’s got that certain…something. Not the flashiest, but gets the job done. Good for a casual punt, maybe. Give it a looksee yourself at 16betbr1.