Hero MotoCorp Share: Latest Price, News, and Future Projections

Hero MotoCorp constitutes an important part of the two-wheeler market in India. Its share price keeps fluctuating under the mutually influential factors of the market and financial performance of this important industry. These fluctuations are watched by investors to see possible returns as well as risk potential.

Historically, the company has been in a position among the major automobile manufacturers and competes with an audience like Bajaj Auto and TVS Motors. Thus, with the borderline changes in this industry, it necessarily becomes a must for potential investors to analyze Hero MotoCorp shares for themselves.

Understanding Hero MotoCorp Share

Hero MotoCorp, the leading firm in the Indian two-wheeler arena, has experienced volatility in its share price as affected by market forces, performance by the company, and macroeconomic parameters. The investors and analysts seem to be interested in these price movements for any investment decisions judging the goodness or the worthiness of the stock.

Hero MotoCorp Share News

The share price of Hero MotoCorp recently saw a fall record low at ₹3,455.30-making it hit a 16-month low, a 24% decline from its peak of ₹4,520.95 touched in February 2025. Events such as changes in leadership, shrinking market share, and exit of executives marred this year for the company-causing decline.

Further, the resignation of CEO Niranjan Gupta, along with top executives, raised red flags among investors, keeping them unsettled in response to increasing competition from electric vehicle manufacturers. Then again, the company saw a very healthy two-wheeler sales growth of 4.3% between April 2024 and February 2025. All these point towards recovery.

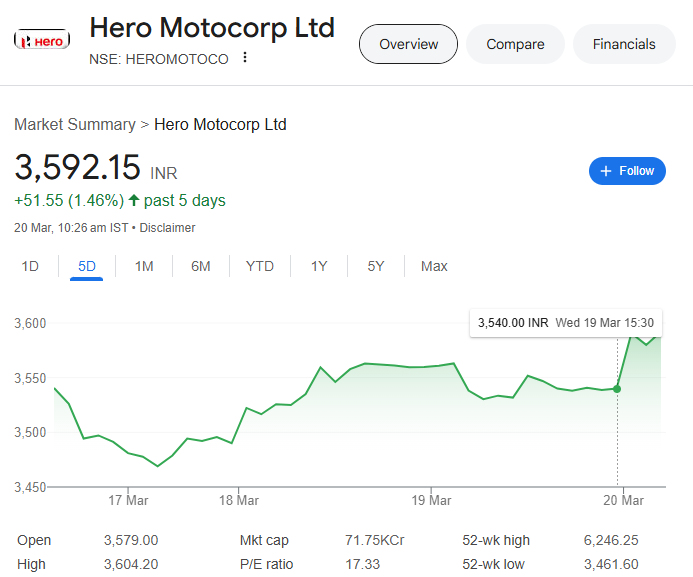

Hero MotoCorp Share Price

Hero Moto Corp’s share prices fell to their lowest in the last 16 months at ₹3,455.30. The shares have fallen by as much as 24% from a zenith of ₹4,520.95, recorded in February 2025. The decline is attributed to changes in leadership, loss of market share, and exits of key executives.

Coach Niranjan Gupta’s resignation, apart from some significant exits by top executives, has alarmed investors, too. It has also created channel levels of market sentiment being dragged down by increased competition coming from electric vehicle manufacturers. However, the firm reported that from April 2024 to February 2025, two-wheeler sales grew by 4.3%, indicating a possible turnaround.

Hero MotoCorp Share Price Target

Short to Medium-Term Price Giovanni:

- 2025 Target: It is expected that the price would tend to stabilize near ₹3,500 depending on the possible changes in leadership and competitive positioning; should the company achieve its strategic plans; a marginal upward incrimination can be expected.

- 2030 Target: Analysts have an estimate of ₹4,500, which is supported by the growing electric mobility space and its market size. Long-term holders may wish to keep their stock as the company adapts to emerging trends and enhances its market share.

Hero MotoCorp Share Price NSE

With a market cap of around ₹60,000 crores, Hero MotoCorp continues to be a stock to consider. It has been a mainstay among the best auto stocks in the country. Daily traded volumes suggest that institutional investors have shown some interest in the stock. Future movements of the share price may be affected by the market conditions, supply-chain disruptions globally, and policy changes in the automotive sector.

Hero MotoCorp Share Dividend

Hero MotoCorp has maintained an uninterrupted dividend declaration for the last many years. The declaration of dividends at the rate of ₹80 per share in FY 2023-24 shows a very strong commitment towards shareholder returns. Having maintained continuous pay-out ratios over the years, Hero MotoCorp remains an attractive investment avenue in the long run.

A position of high dividend yields means stability in earnings and the economy, and some of the earnings should be used for dividend pay-outs depending upon future earnings growth and capex. Investors need to keep quarterly records to track dividend sustainability.

Hero MotoCorp Share Price History

Understanding past stock trends helps investors evaluate the company’s stability.

| Year | Opening Price (₹) | Closing Price (₹) | Annual High (₹) | Annual Low (₹) |

| 2020 | 2,400 | 2,800 | 3,000 | 2,200 |

| 2021 | 2,800 | 3,100 | 3,400 | 2,600 |

| 2022 | 3,100 | 2,900 | 3,200 | 2,500 |

| 2023 | 2,900 | 3,050 | 3,200 | 2,700 |

| 2024 | 3,050 | 2,950 | 3,100 | 2,800 |

Hero MotoCorp Share Price Target 2030

Demand for two-wheelers, the shift of the company toward electric vehicles, and economic considerations could propel the share price to ₹4,500 by 2030. Investment in sustainable mobility and digital transformation might propel long-term growth. High growth drivers are government incentives for electric vehicles and rising disposability income in India.

However, competition from new entrants and changes in regulations might be threats to this growth. Investors should watch the company’s financial performance and innovation with respect to its products.

| Month | Target |

| January | ₹7,262.35 |

| February | ₹7,595.69 |

| March | ₹7,929.03 |

| April | ₹8,195.70 |

| May | ₹8,162.37 |

| June | ₹8,329.04 |

| July | ₹8,562.38 |

| August | ₹8,462.37 |

| September | ₹8,795.71 |

| October | ₹8,895.71 |

| November | ₹8,759.38 |

| December | ₹8,506.18 |

FAQs

Is Hero MotoCorp a good stock to buy?

As of March 2025, it looks a good stock to buy with an average target of 5672.40.

What is the price target for HEROMOTOCO in 2025?

As of March 19, 2025, analysts predict a Hero MotoCorp (HEROMOTOCO) share price target of around ₹4,811.72, with a maximum estimate of ₹6,200 and a minimum of ₹3,300.

Is Hero MotoCorp overvalued?

Hero MotoCorp is somewhat undervalued by 17% compared to its estimated relative value of 4,260.35 INR, while the DCF valuation suggests it is overvalued by 1%.

What is the PE ratio of a hero?

As of March 20, 2025, Hero MotoCorp’s P/E ratio (Price-to-Earnings Ratio) is approximately 16.82.