GST 2.0 Unveiled: New 5% & 18% Slabs Slash Rates by Diwali 2025

New GST Rates: In a significant revamp to make India’s tax regime simpler, the GST Council has launched GST 2.0, which brings in a simplified two-tiered system of 5% and 18% for most goods and services. The decision was made after the most recent council meeting and comes at a time when consumers and businesses can look forward to relief from reduced rates on common items just before the festive season. With Diwali in late October 2025, these transitions are going to bring down the expense burden on families during increasing costs.

Update on New GST Rates

The good news from the recent GST Council meeting is the transition from the previous four-slab system (5%, 12%, 18%, and 28%) to a more streamlined configuration. Finance Minister Nirmala Sitharaman emphasised that this change will make taxes more predictable and improve economic growth. There is a new 40% slab introduced for sin and luxury items such as high-end vehicles and tobacco products, while essentials face reductions in order to contain prices. Individual health insurance policies will be exempt from GST, giving families additional savings.

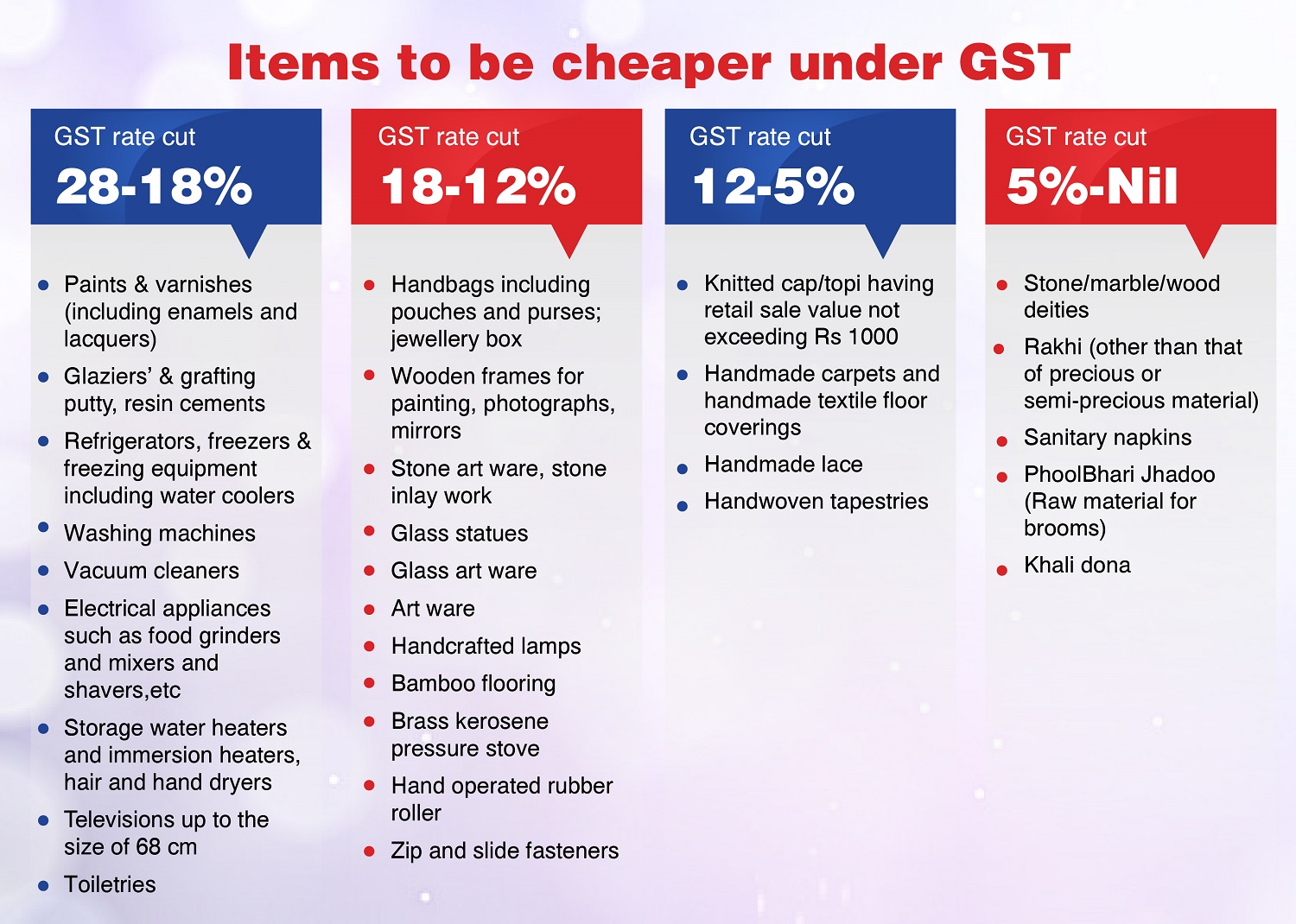

New GST Rates List 2025

Most items at the old 12% or 28% are shifting downwards in the revamped new list. For example, bicycles and components fell from 12% to 5%, becoming more accessible for daily commuters. Electronics such as TVs and certain packaged foods also see cuts. The 40% rate will go after goods such as aerated beverages, cigarettes, and luxury cars with large engines, where the tax can go as high as 50% with the cess. The well-balanced strategy seeks to stem excess while encouraging necessary expenditure.

When Do the New GST Rates Come into Effect?

The rollout is quick to have maximum effect prior to the festive season. Reforms take effect immediately after the announcement, with complete implementation timed for the festive season rush. Firms have limited time to reconfigure systems, facilitating easy transactions for consumers prepping for Diwali festivities.

Effective Date for New GST Rates

Mark your calendar: The new rates will come into effect from September 22, 2025, providing a head start for everyone prior to Diwali. Since the date is early, lower costs on festival items such as sweets and devices may materialise sooner, making it easier for families to budget during preparations.

Where to Find the New GST Rates List PDF

For the detailed analysis, visit official websites such as cbic.gov.in or gst.gov.in. The Central Board of Indirect Taxes and Customs has issued notifications in PDF form, such as CGST Rate Notification 1/2025 for products such as fortified rice at 5%. These sheets present slab shifts and exemptions in a way that is easy for traders and consumers to access without hassle. Here is the PDF regarding the new GST rates list of 2025. Refer to it to get more detailed information and understanding of the new GST rates:

New GST Rates on Mobile Phones

Smartphones are still in the 18% category under the new regime, since there was no particular reduction mooted for this segment. But with the overall rationalisation, allied accessories could indirectly gain if they move from higher slabs, so that technology is affordable for the younger generation and professionals.

New GST Rates on Paper

Paper items, such as stationery like pens, have shifted to 18% from earlier rates of around 12%. This change impacts school stationery and office supplies, but the council assures that it forms part of the overall attempts at harmonising taxes without significant increases on essentials.

New GST Rates on Food Items

Food receives a welcome breather. Products such as roti, paratha, and fortified rice kernels now come under 5%, reduced from the previous higher percentages. Packaged snacks and namkeens have been reduced to 12% from 18%, while necessities such as loose flour remain exempted. This translates to lower-priced groceries, particularly for middle-class families prepping for Diwali parties.

Overall, GST 2.0 is a step in the direction of a more equitable tax system, reducing complexity and expense. As India marks this festive season, these reforms could trigger increased consumption and growth, demonstrating that simpler taxes work for all.

FAQs

What are the new GST rates?

The GST Council of India announced that from 22 September, only 2 rates will remain, 5% and 18%. There is a special percentage of 40% on pan masala, cigarettes, aerated water with added sugar, carbonated beverages, etc.

Which items have 28% GST?

Under the new GST 2.0 structure effective from September 22, 2025, the 28% slab has been largely phased out, with most items moved to 5% or 18%. Luxury and sin goods like tobacco, aerated drinks, and high-end vehicles now fall under a special 40% slab, which can reach up to 50% with cess.

What will come under 40% GST?

The GST Council has increased the tax on sin and super luxury goods under a special rate of 40 per cent. The tax on pan masala, tobacco products, cigarettes and all automobiles above 1,200 cc and longer than 4,000 mm will attract 40 per cent GST.

What is the GST rate slab for 2025?

The Goods and Services Tax (GST) Council has finalised the GST rate cuts. Most items will now be covered under two tax slabs: 5% and 18%.

What are the changes in GST 2025?

In 2025, GST 2.0 simplifies rates to 5% and 18% slabs, phasing out 12% and 28%, with luxury goods at 40% (up to 50% with cess). Essentials like health insurance, fortified rice, and loose flour are exempt, effective September 22, 2025.

Hey guys, just checked out tai88vinlink and gotta say, it’s pretty slick! Seems like a decent spot to try your luck. Check it out for yourselves at tai88vinlink.

Yo, tried the sv368app on my phone. Installation was easy, and the interface is clean and intuitive. Found what I needed pretty quick. You can find it here: sv368app

888pgvip is where the big boys play. I might not be a VIP just yet, but I’m working on it! They’ve got all the high-roller games, so if you’re feeling lucky, give it a shot! You can thank me later. 888pgvip is where the action is at.